Middleware Software Integration for Mobile Banking Application

- Industry:

- FinTech

Introduction

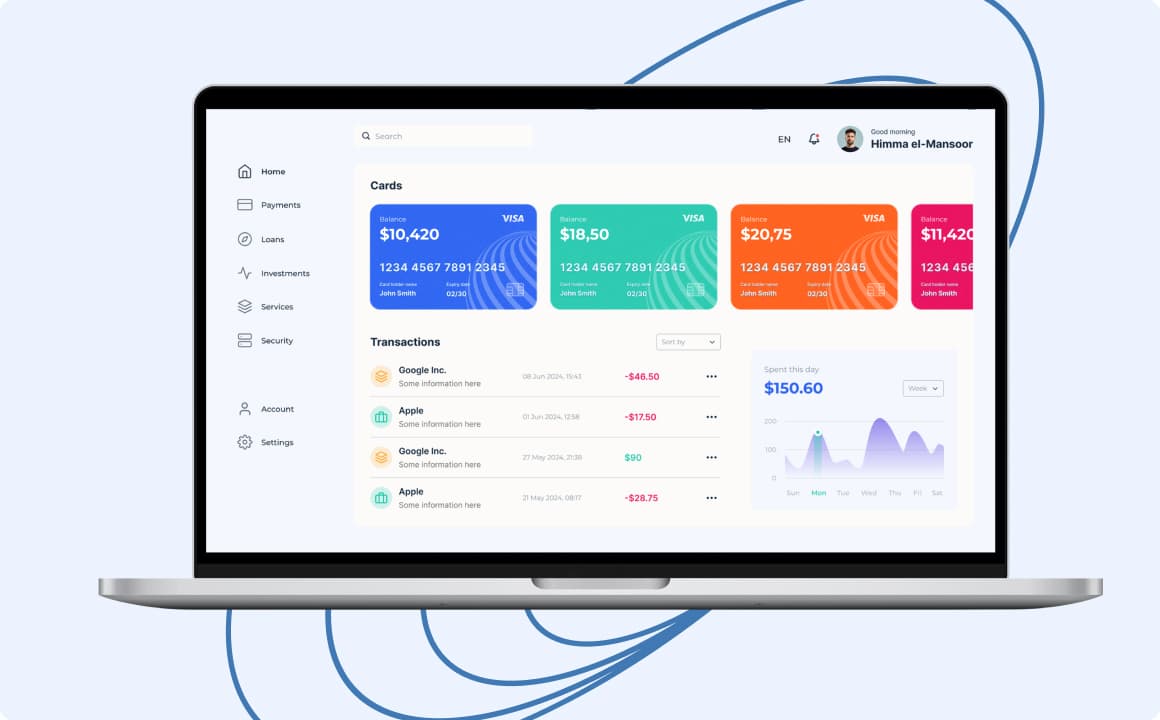

The prominent financial institution in the Middle East, embarked on an ambitious digital transformation journey to elevate the banking experience for its customers. As part of this transformation, the customer aimed to develop a comprehensive Mobile Banking App that would empower customers to access a wide range of banking services conveniently on their mobile devices.

The challenge was to seamlessly integrate numerous features, such as account management, fund transfers, mobile check deposit, bill payments, and more, while ensuring data security and scalability. To address these challenges, the customer opted to leverage the Middleware layer to bridge the integration gap between the native iOS and Android apps back-end and the core banking systems.

Background

In a bid to digitize its internal processes and promote financial well-being among its customers, the customer embarked on the development of a cutting-edge payment application. The goal was to have a system that is convenient, efficient, and user-friendly, accessible through iOS and Android devices.

Challenges

Feature Integration

Merging diverse features into one cohesive app without compromising user experience.

Data Integration

Bridging the technical disparity between mobile apps and the bank’s myriad core systems.

Security

Upholding the gold standard in data security and privacy, a non-negotiable in banking.

Scalability

Building a robust system to support the bank’s growing clientele and rising transaction volumes.

Team Composition

-

Project Manager

-

Cybersecurity Ops Engineer

-

Backend Developers

-

UI/UX designer

-

Frontend Developers

-

Business Analyst

-

Mobile App Developers

-

DBA Engineer

-

Solution Architect

-

QA Engineer

Tech Stack

-

ElasticSearch

-

Vue.js

-

React.js

-

Docker

-

Kubernetes

-

Jenkins

-

Ruby

-

Ruby on Rails

-

Java

-

PHP

-

Go

-

Grafana

-

Grafana Loki

-

Grafana Tempo

-

Prometheus

-

OpenTelemetry

-

IBM APP Connect

-

Absher

-

mada

-

IBM API Connect

-

Unifonic

-

SADAD and more

Solution

The project team decided to implement a middleware solution that acted as a bridge between the native iOS and Android apps and Bank’s core banking systems. Here’s how the solution was implemented:

- Feature Integration From account management to ATM locators, a slew of features were integrated into a seamless interface.

- Security Cutting-edge security protocols like TLS/SSL encryption and OAuth 2.0 fortified the app. Regular audits further bolstered defenses.

- Data Integration MiddleWare enabled real-time data flow, ensuring instant updates and retrievals.

- Logging aggregator Designed to thrive on AWS, the system seamlessly scales, accommodating growing user traffic.

Results

Holistic banking services within a unified app.

Decreased reliance on bank support, elevating customer satisfaction.

Unwavering commitment to data privacy and security.

Flexible architecture catering to escalating user demands.

The Road Ahead

Enriching the app with advanced financial tools.

Integrating AI for personalized financial insights.

Global expansion to cater to international clientele.

Prioritizing user feedback for continual refinement.

Scalability tweaks to handle burgeoning user numbers.

Conclusion

Middleware software became the cornerstone of this transformative project, addressing interoperability challenges head-on. As the bank ventures into the future, it stands tall as a beacon of FinTech innovation, all set to redefine the digital banking paradigm.